Yet we're still faced with the same reality of rising costs for public safety, at about a 7% per year clip, as our neighboring cities.

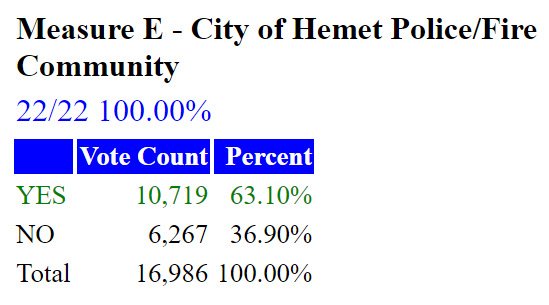

We've recently seen Hemet attempt to pass a 1% sales tax increase with a ballot measure.

Since it was a special purpose tax it required a 2/3 majority to pass. It fell about 4% short.

But that election result didn't deter them, it just got them looking to put a general tax increase on the ballot this time... which happens to only need a 50% vote to pass.

Let me digress for a moment

Wouldn't it make more sense that if one of the two tax types were to only take a simple majority to pass, it be the Special Purpose tax, that has narrow parameters... and the General tax, that just goes into the general budget, be the one that would take a super majority?

I was at a public meeting recently where there was a legislative update portion. It was there that a Temecula city councilmember spoke glowingly of the new 1% sales tax increase they just approved for the ballot.

That's with an existing surplus of $21 million from what I heard.

Here's a link to a recent Press Enterprise editorial that mentions both Hemet and Temecula's city council putting such measures on the 2016 November ballot.

BTW, adding one cent to the existing sales tax is NOT a 1% increase. Currently the sales tax in Temecula is 8%. Adding a full percentage point is actually an increase of 12.5%.

Temecula has paid many thousands of their taxpayer's dollars to a polling firm Fairbank, Maslin, Maullin, Metz and Associates, also known as FM3, to help ensure tax increases are a viable option for their city to pursue.

Also looking to raise taxes is Menifee, by the same 12.5%, but they'd tell you it's 1%, since it would only be an additional penny per dollar.

So I sent out an email to all five of the city council members of Wildomar with the following question:

WR You've seen that several surrounding communities are looking to place tax increase measures on the ballot to shore up their budgets. Wildomar is facing the same issues with ever increasing costs for first-responders. Has there been talk of a tax increase here, and if not, do you see one on the horizon? If so, or even if not, what would the steps be before such a thing would be voted on by the council?

Mayor Bridgette Moore

Our efforts are, and have been, focused on recovering our $2million General Fund recurring revenues that the State took from us, starting in July 2011.

Hopefully, the legislation to restore our annual funding will be approved soon or at least when the Governor is replaced in January 2019.

The other cities, proposing sales tax increases, are trying to maintain their current service levels for pubic safety and basic services because the property tax revenues from residential development does not cover the cost of services.

In Wildomar, we have taken the necessary steps to assure that new development does not have a negative fiscal impact on our General Fund.

Could the residents of Wildomar benefit from a sales tax increase? Of course! Currently, the city sales tax revenue is about $1.3 million per year.

It all comes down to, what kind of a community do you want and are our citizens willing to pay for?

IF there was to be discussion on a sales tax increase, it would be put on a future agenda item. The public would be invited to attend and give their input.

Mayor Pro-Tem Tim Walker

No, there is no plan to make a special tax to cover the shortfall. I have always said to increase revenue through the commercial enterprises. Making it easier for businesses to come here and get established. That's my plan. Living within our means is what I have to do and making cuts is always the first option.

No, there is no plan to make a special tax to cover the shortfall. I have always said to increase revenue through the commercial enterprises. Making it easier for businesses to come here and get established. That's my plan. Living within our means is what I have to do and making cuts is always the first option.

Councilmember Marsha Swanson

I am, and have always been, against raising tax. If I am working and don't make enough money to pay my bills I have several choices. Spend less, ask my boss for a raise, or get a second job. I always think personally I can do with less. The citizens may not want to do with less and that is their choice to make.

I have not heard of anyone with the city or council talking about asking the citizens to raise taxes.

The comments from the other two councilmembers didn't arrive in time for publication, but I'll happily add them to this blog once I get them.

There is a candidate for city council, Dustin Nigg, that is running in district 2 (The Farm) and I thought it would be good to get his input on this too.

Since he's not on the council, I had to reword the question a bit.

WR You've seen that several surrounding communities are looking to place tax increase measures on the ballot to shore up their budgets. Wildomar is facing the same issues with ever increasing costs for first responders. Do you have a position on tax increases as a candidate for city council?

Dustin Nigg, candidate 2nd district

As a conservative I tend to flinch when additional taxes are mentioned because I believe that there are other avenues to broach before discussing tax increases. Questions I would ask myself would be

1. Are we doing enough to facilitate a growth in business for our city? The idea is to bring businesses to our community which thereby creates jobs and money in our city.

2. Is there any wasteful spending in the current budget? Can we use money that is allocated elsewhere?

3. How does this benefit our community and is it important to our citizens?

I feel that public safety is important to our community and is an important issue for our citizens but I would be hesitant to support any increase in tax until I was satisfied that we as representatives of our community had done EVERYTHING possible to find a way to fix the problem without a new tax measure.

As a conservative I tend to flinch when additional taxes are mentioned because I believe that there are other avenues to broach before discussing tax increases. Questions I would ask myself would be

1. Are we doing enough to facilitate a growth in business for our city? The idea is to bring businesses to our community which thereby creates jobs and money in our city.

2. Is there any wasteful spending in the current budget? Can we use money that is allocated elsewhere?

3. How does this benefit our community and is it important to our citizens?

I feel that public safety is important to our community and is an important issue for our citizens but I would be hesitant to support any increase in tax until I was satisfied that we as representatives of our community had done EVERYTHING possible to find a way to fix the problem without a new tax measure.

I've extended an invitation to Dustin to be part of a "Better Know A Candidate" blog, as I also have with incumbent Councilmember Bob Cashman.

If all goes well, those should be coming online in late September, early October as we get closer to election day.

• • •

|

The future should be important to you. That's where you'll spend the rest of your life.

—Grandma from Family Circus, Bil Keene

—Grandma from Family Circus, Bil Keene

Wildomar Rap looks to the heavens, shoots for the stars but knows that terra firma is the place to keep one's feet.

This cities tax increase are hidden in the form of CFD's aka Mello Roos. Its going to be interesting to see how new homeowners are going to react to paying for, trailheads for all, with those tract specific Mello Roos service fees. The other cities will soon find that the 1% sales tax increase will not cover the ever spiraling cost of public safety, especially with more and more sales conducted online where sales taxes collected are going elsewhere, then being kicked back to businesses as incentives to build mega warehouses.

ReplyDeleteI'm glad that when I bought in Wildomar that we made sure that there were no Mello Roos. People that buy into any places with CFDs know about it from the start, but I doubt many of them consider the built in increases that come with them.

DeletePublic safety costs are out of whack. Thing is, if a person says that too loudly they might get accused of disliking the cops and firefighters. I like them just fine, it's their unions I have little respect for... same goes for the teachers union.

As we continue to move into the future, opening a retail store seems like a dumb thing to do. It's impossible to compete with big box stores, and even some of those can't hack it over time. Food industry businesses and service related businesses should be safe from internet purchases, but they have a lot of regulations they have to deal with just to open their doors and that's before they make their first sale.

So, I have to agree that increasing the sales tax, as Temecula has done, is a shortsighted fix.